Keep in Touch – Client March 2024

March 10, 2024

Keep in Touch – Client October 2024

October 30, 2024Keeping in Touch – August 2024

Client Newsletter

Welcome back to our loyal clients and welcome to our new clients. Thank you for choosing Jones Insurance.

So I promised in our last newsletter that I would get back from my insurance meeting in Vancouver with some great one liners… here you go, my favourites first…

- Every heartbeat counts, so don’t waste them.

- Your life is like an egg, great things begin on the inside.

- We are more alike than we are different, perspective matters, live life well.

- Say no to something in the next 7 days, Build a “no muscle.”

- Preparation makes you great – Over prepare!

Hopefully one or two of these resonates with you.

Now to insurance ..

Have you booked an insurance review with us in the last 2 years? If not I’m sure something has probably changed in your life that will affect your financial plans and your insurance needs. Has your income changed? Do you remember the benefits that your current insurance policy offers?

Is it time to look at income protection or better cancer cover?

If you would like to book an insurance review, please email Jayne at info@jonesinsurance.co.nz to set up a time that suits you to chat with me. We will lock it in.

Thank you so much for trusting me and Jones Insurance to continue looking after your personal insurance plan – please do keep in touch.

In this issue we’ll be looking at:

- How Premiums are Calculated

- Income Protection Cover

- Managing claims and policy alterations with NIB

- Recipe of the Month: Avocado Pasta

Enjoy your day,

Paula Jones

FSP82763

How are your Premiums Calculated?

Have you ever wondered how premiums are calculated?

Have you ever noticed that your spouse, partner or children have different premiums for similar or identical cover?

Let’s try to make sense of the dollars and cents!

The premium for your benefits are based on actuarial statistics, or data that is gathered, compiled and studied by an Actuary. In simple terms, an Actuary is someone who deals with the measurement and management of risk or uncertainty. In the insurance industry, an Actuary is responsible for analysing the possible outcomes of the types of events that could potentially result in claims.

The more likely you are to claim, the higher your premiums will be.

This is the life insurance version of ‘user pays’ and helps ensure that the widest possible mix of both healthy and not so healthy clients are attracted to buy insurance, so that the collective risk of claims can be spread amongst this wide mix of clients.

Life Insurers are allowed to price differently on the basis of age, gender and disability provided that this different treatment is supported by actuarial or statistical data, clearly showing different risk profiles for people of different demographics. If no actuarial or statistical data is available for a particular demographic (for example, an individual with a very rare combination of diseases or disorders), pricing based on expert medical opinion of the risk is also allowed.

Source – Partners Life

What is Income Protection?

Income Protection protects your most valuable asset – your future income.

It provides a financial safety net should you be disabled as a result of sickness or injury and unable to earn your regular income. The monthly benefit helps replace a significant portion of the lost income to help maintain your usual lifestyle during treatment and recover.

How long will you income continue if you are ill or unable to work?

Managing claims and policy alterations with NIB

NIB re-launched the member portal and the mynib app a few months ago and its functionality is second to none. Members can submit a claim, submit a pre-approval, update their personal details, make changes to their cover (including excesses) and change payment details. They can also complete a personalised health check and find a health provider.

It’s really easy to navigate and find your way around. Below are some screen shots from the mynib app:

The best thing about it is the engine that runs this functionality can make decisions and take actions to process the claim/query efficiently and quickly. If it can’t take the necessary action it will send the query to the relevant team for them to process.

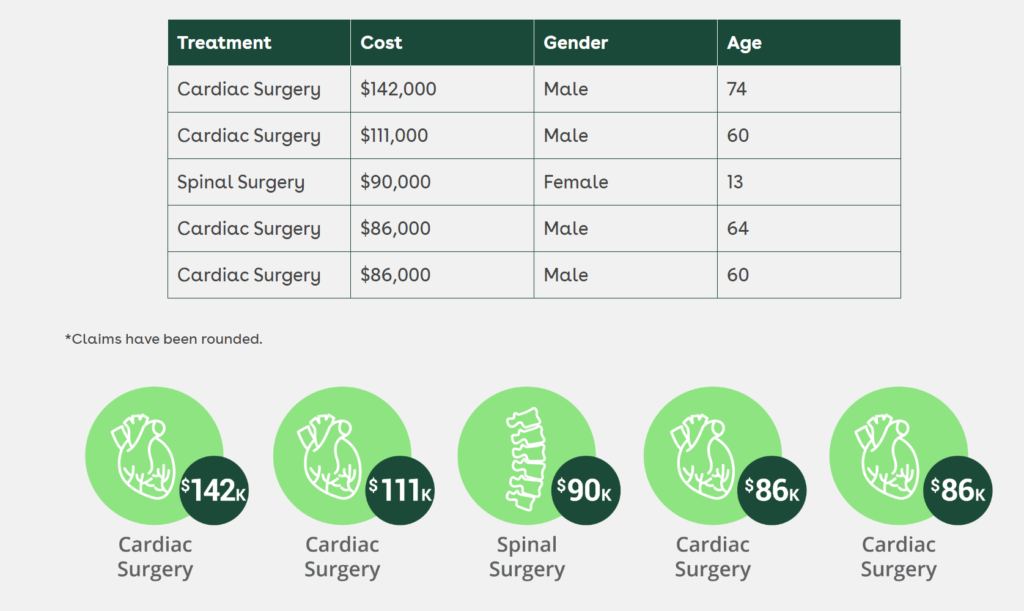

NIB’s Top 5 Claims – June 2024:

Recipe of the Month – Avocado Pasta

With the cheap price of avocados currently, here is an easy pasta recipe utilising these.

- 2 ripe avocados

- 1/4 cup fresh basil leaves (or spinach)

- 2 cloves garlic

- 2 tablespoons lemon juice

- 1/4 cup olive oil

- Salt and pepper to taste

- 12 ounces pasta (spaghetti, fettuccine, or your choice)

- Cherry tomatoes (optional)

- Grated Parmesan cheese (optional)

Method:

Cook the Pasta: Cook the pasta according to the package instructions until al dente. Reserve about 1/2 cup of pasta water before draining.

Prepare the Avocado Sauce:

- While the pasta is cooking, scoop the flesh of the avocados into a blender or food processor.

- Add the basil leaves, garlic, lemon juice, and olive oil.

- Blend until smooth. If the sauce is too thick, you can add a little pasta water to reach your desired consistency.

- Season with salt and pepper to taste.

Combine Pasta and Sauce:

- In a large bowl, toss the cooked pasta with the avocado sauce. Make sure the pasta is well coated. Add more pasta water if needed to help distribute the sauce evenly.

Add Optional Toppings:

- For a fresh touch, add halved cherry tomatoes.

- Sprinkle with grated Parmesan cheese for extra flavor.

Serve: Serve immediately while the pasta is warm.

Enjoy your creamy and delicious avocado pasta!

Positive thinking:

‘This time, like all times, is a very good one if we but know what to do with it.’Insurance Thought

The premium is not the problem; the premium is the solution to your problem.Follow us on Facebook: https://www.facebook.com/JonesInsuranceConsultants/

Free source and thank you

Why Jones Insurance Consultants?

We are specialists who protect individuals and their families against the unexpected and the inevitable.